What to Know Before Buying a Home: A Comprehensive Guide

Buying a home is one of the most significant decisions you'll make in your life. Whether it's your first home or an upgrade to your forever home, the process can be both exciting and overwhelming. At elevated & co. realty, we believe that being well-prepared can make all the difference. Here's what you need to know before buying a home: 1. Understand Your Financial Situation Before you start house hunting, it’s essential to have a clear understanding of your finances. This includes knowing your credit score, the amount you have saved for a down payment, and how much you can afford to spend on a home. Lenders typically recommend that your mortgage payment should not exceed 28% of your gross monthly income. Getting pre-approved for a mortgage can also give you a clearer picture of your budget and make you a more attractive buyer to sellers. 2. Know What You Want vs. What You Need It’s easy to get caught up in the excitement of buying a new home, but it’s crucial to differentiate between your needs and wants. Start by making a list of must-have features versus nice-to-have features. For example, the number of bedrooms and bathrooms might be non-negotiable, while a pool or finished basement could be more of a bonus. This clarity will help you stay focused and avoid getting distracted by homes that don’t truly meet your needs. 3. Research the Neighborhood The location of your home is just as important as the home itself. Consider factors like proximity to work, school districts, public transportation, and the overall safety of the area. Visit neighborhoods at different times of the day and week to get a feel for the community. It’s also wise to check future development plans in the area, as these can impact property values and your quality of life. 4. Consider the Long-Term When buying a home, think beyond your current needs. Are you planning to start or expand your family? Will your aging parents need to live with you in the future? How does the home's layout fit with your long-term plans? Choosing a home that can adapt to your changing lifestyle can save you the hassle of moving again in a few years. 5. Don’t Skip the Home Inspection A home inspection is a critical step in the home-buying process. It’s your chance to uncover any potential issues with the property before you commit. From structural problems to pest infestations, a thorough inspection can save you from costly surprises down the road. At elevated & co. realty, we can recommend trusted inspectors who will provide a detailed report on the home’s condition. 6. Understand the Market Real estate markets can vary greatly depending on location and timing. Understanding whether you’re in a buyer’s market or a seller’s market can influence your strategy. In a buyer’s market, you might have more room to negotiate on price or ask for concessions. Conversely, in a seller’s market, homes may sell quickly and at a premium, requiring you to act fast and be competitive. 7. Plan for Additional Costs Beyond the purchase price, there are other costs associated with buying a home that you need to budget for. These can include closing costs, property taxes, home insurance, and ongoing maintenance expenses. It’s important to factor these into your budget to ensure that your dream home doesn’t become a financial burden. 8. Work with a Trusted Real Estate Agent Navigating the home-buying process can be complex, but you don’t have to do it alone. Working with an experienced real estate agent, like those at elevated & co. realty, ensures that you have a professional advocate on your side. We guide you through each step of the process, from finding the right home to negotiating the best deal and closing the sale. Our Elevated Living Method guarantees a tailored experience designed to meet your unique needs and exceed your expectations. 9. Be Ready to Move Quickly In competitive markets, the best homes don’t stay on the market for long. If you find a home you love, be prepared to make an offer quickly. This is where having your finances in order and working with an experienced agent can give you an edge over other buyers. 10. Celebrate Your New Home Finally, remember that buying a home is a significant achievement. Once the keys are in your hand, take the time to celebrate this milestone. Whether it’s hosting a housewarming party or simply enjoying the first night in your new space, make sure to mark the occasion and settle into your new home with joy. At elevated & co. realty, we’re here to ensure your home-buying journey is smooth, informed, and successful. With our expert guidance, you’ll find a home that not only meets your needs today but also supports your dreams for the future. Ready to start your journey? Contact us today to begin the process of finding your dream home.

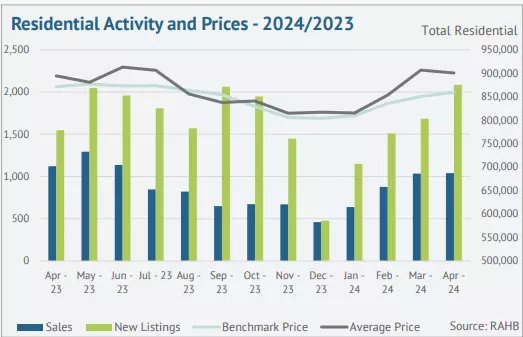

April Market Stats - SALES ACTIVITY SLOW AS NEW LISTINGS RISE - PRICES TREND UP OVER LAST MONTH, BUT REMAIN BELOW LAST YEAR'S LEVELS

The REALTORS® Association of Hamilton-Burlington (RAHB) reported 1,041 sales in April, marking a seven percent decline compared to April 2023. This sales activity is well below long-term trends for the month. Despite the slowdown in sales over the past two months, year-to-date sales are similar to those recorded in 2023. Apartment home sales saw a modest decline compared to last year, but this was offset by increased sales of semi-detached and row-style units. New Listings on the Rise In April, new listings rose to 2,085 units, leading to a sales-to-new listings ratio of 50 percent and driving further inventory gains. Inventory levels increased across all property types and price ranges. Although this increase in inventory is significant compared to 2023, it's important to remember that inventory levels have been exceptionally low for most of the past decade. Inventory and Months of Supply The rise in inventory compared to sales affected the months of supply, which trended up over March and last year's levels. In April 2023, both Hamilton and Burlington reported monthly supplies below two months, with the tightest conditions in Burlington. While these areas still have tight market conditions, they also reported the most significant year-over-year inventory gains. Impact of Higher Lending Rates “Higher lending rates continue to weigh on potential purchasers, with some delaying any decision until later this year. At the same time, we continue to see new listings rise, providing more choice in the market and preventing any significant shifts in home prices,” says Nicolas von Bredow, President of the REALTORS® Association of Hamilton-Burlington (RAHB). Price Trends The unadjusted benchmark price increased over March, reaching $859,600 in April. Despite the monthly gains, prices were slightly over one percent lower than in April 2023. Prices trended up over the last month across all regions in the RAHB market area. However, Haldimand County is the only area that reported a year-over-year price gain. Conclusion In summary, the Hamilton and Burlington real estate market in April 2024 saw a decline in sales activity and a rise in new listings. While prices trended up over the last month, they remain below last year's levels. Higher lending rates and increasing inventory are influencing market dynamics, providing more options for buyers and preventing significant price increases. For detailed market insights and personalized real estate advice, contact Elevated & Co. Realty. Our team of expert real estate agents is here to help you navigate the Hamilton and Burlington real estate market with confidence.